In the fast-evolving world of digital finance, the Uphold Wallet stands out as a versatile multi-asset platform designed for seamless trading and storage of cryptocurrencies, fiat currencies, precious metals, and more. Launched in 2015 and headquartered in New York City, Uphold has grown to serve users in over 140 countries, supporting more than 300 assets as of 2025. This review dives deep into what makes the Uphold Wallet a compelling choice for beginners and experienced investors alike, covering its core features, security protocols, fee structure, and practical usage tips.

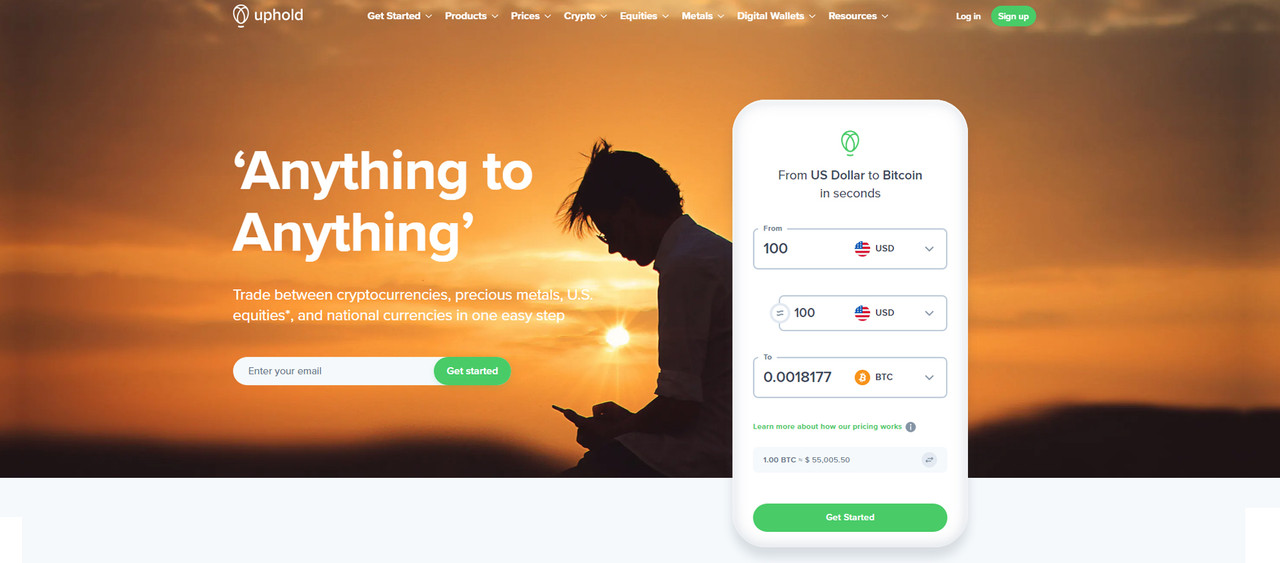

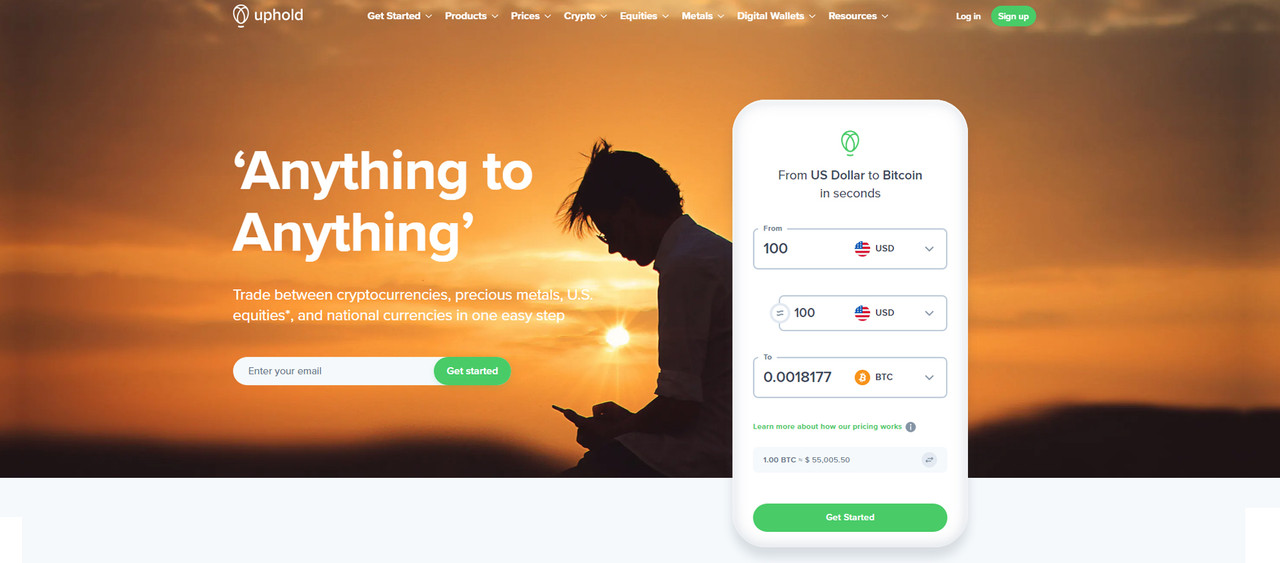

The Uphold Wallet is more than just a storage solution; it's an integrated digital platform that combines exchange functionality with wallet capabilities. Unlike traditional crypto wallets that focus solely on holding assets, Uphold enables users to buy, sell, trade, and convert between diverse asset classes in a single interface. This "anything-to-anything" trading model allows direct swaps, such as converting Bitcoin to gold or USD to Ethereum, without multiple steps or intermediaries.

At its core, the wallet is custodial by default, meaning Uphold manages private keys for ease of use. However, it offers advanced options like assisted self-custody through the Uphold Vault and full self-custody via the UpHODL Web3 Wallet. This flexibility caters to varying levels of user expertise, from novices who prefer simplicity to advanced users seeking full control. As of 2025, Uphold's platform is accessible via web, iOS, and Android apps, with real-time market data and transparent reserves ensuring users always know their assets are backed 1:1.

Uphold's evolution from a Bitcoin-focused wallet to a comprehensive financial hub reflects its commitment to innovation. It supports staking for select assets, interest-earning accounts for USD, and even a debit card for spending crypto worldwide. With regulatory compliance across major jurisdictions like the US (FinCEN), UK (FCA), and Canada (FINTRAC), Uphold prioritizes trust and accessibility in a space often marred by volatility and scams.

Uphold's feature set is designed to streamline digital asset management while offering unique tools not found on many competitors. Here's a breakdown of its standout capabilities:

One of Uphold's hallmark features is its one-step trading system, allowing users to exchange any supported asset for another directly. For instance, you can swap XRP for silver or Ethereum for British Pounds in a single transaction, bypassing the need for fiat conversions or cross-chain bridges. This is particularly useful in 2025's fragmented blockchain landscape, where interoperability remains a challenge. The platform handles over 300 cryptocurrencies, including majors like BTC, ETH, and SOL, alongside stablecoins, ERC-20 tokens, and NFTs via UpHODL.

Earn passive income effortlessly with staking on assets like ETH and SOL, yielding up to 5-10% APY depending on market conditions. Additionally, the USD Interest Account provides competitive rates on fiat holdings, insured by FDIC-partnered banks up to $250,000. These features make Uphold a hybrid savings-investment tool.

The Uphold Card turns your wallet into a spending powerhouse. Load it with any asset, convert on-the-fly, and spend anywhere Visa is accepted with 0% foreign transaction fees. Real-time notifications and low exchange rates enhance its utility for travelers and daily users.

Uphold invests in user empowerment through guides, market insights, and a real-time Proof of Reserves dashboard. This transparency verifies that every asset is fully backed, a critical trust factor post-2022's exchange failures.

Security is non-negotiable in crypto, and Uphold excels here with a multi-layered approach. The platform stores approximately 90% of user funds in cold (offline) storage, protected by multi-signature protocols that require multiple approvals for transfers. Hot wallets handle daily operations with minimal exposure.

Account-level protections include mandatory KYC verification to deter illicit activity, two-factor authentication (2FA) via Google Authenticator or SMS, and biometric logins (FaceID/TouchID) on mobile. Device authorization adds another barrier, while the platform's SOC 2 Type 2, ISO 27001, and PCI DSS certifications validate its data handling practices.

Despite these strengths, crypto isn't insured like bank deposits—users bear the risk of market losses or personal errors. However, Uphold has never suffered a major hack as of 2025, and its bug bounty program incentivizes vulnerability reporting. For enhanced safety, enable time-based 2FA and use the Vault for long-term holdings. Independent audits and segregated client funds further mitigate counterparty risk.

Regulatory adherence is robust: Uphold complies with MiCA in the EU (delisting non-compliant stablecoins like USDT in 2024) and publishes quarterly transparency reports. While not offering deposit insurance for crypto, fiat in interest accounts benefits from FDIC coverage.

Uphold's breadth is impressive, with over 300 cryptocurrencies encompassing blue-chips (BTC, ETH), altcoins (XRP, HBAR), and emerging tokens. Beyond crypto, trade fiat (USD, EUR, GBP), precious metals (gold, silver, platinum), and equities via partnerships. This diversification suits portfolio builders aiming to hedge against volatility.

Trading pairs number in the thousands, enabling exotic swaps like crypto-to-metal. Liquidity is solid for majors, though spreads widen for low-volume assets. Minimums are low ($1-10), making it accessible for micro-investors.

Uphold's fees are transparent but can add up. Trading incurs spreads of 0.65-1.95% (higher for illiquid pairs), with no commission on swaps. Withdrawals vary: crypto network fees plus 0-2.5% (e.g., 0.003 LTC ~$0.19), fiat via ACH free in the US but $0.99+ elsewhere. Deposits are generally free, except wire transfers ($10+).

The Vault subscription offsets some costs with zero internal transfers. Compared to Binance's lower withdrawal fees, Uphold prioritizes speed and simplicity over rock-bottom pricing. No hidden charges, but volatility can inflate spreads—always check real-time quotes.

Setting up is straightforward:

For withdrawals, select the asset, enter details, and confirm. Mobile users appreciate the intuitive UI, though desktop lacks biometrics.

Pros:

Cons:

For beginners seeking an all-in-one solution or diversified investors wanting crypto-fiat-metal exposure, Uphold shines. Its security track record, regulatory compliance, and innovative features like Vault make it a safe bet amid 2025's regulatory shifts. However, high-volume traders might prefer lower-fee exchanges like Binance, and advanced users could outgrow its basic tools.

Ultimately, Uphold's emphasis on transparency and ease positions it as a reliable gateway to digital assets. With ongoing expansions—like more Vault-supported tokens and DeFi integrations—it's poised for growth. Start small, enable all security layers, and leverage its educational resources to maximize value.

(Word count: 1,248)